- #BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE FULL#

- #BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE OFFLINE#

- #BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE PLUS#

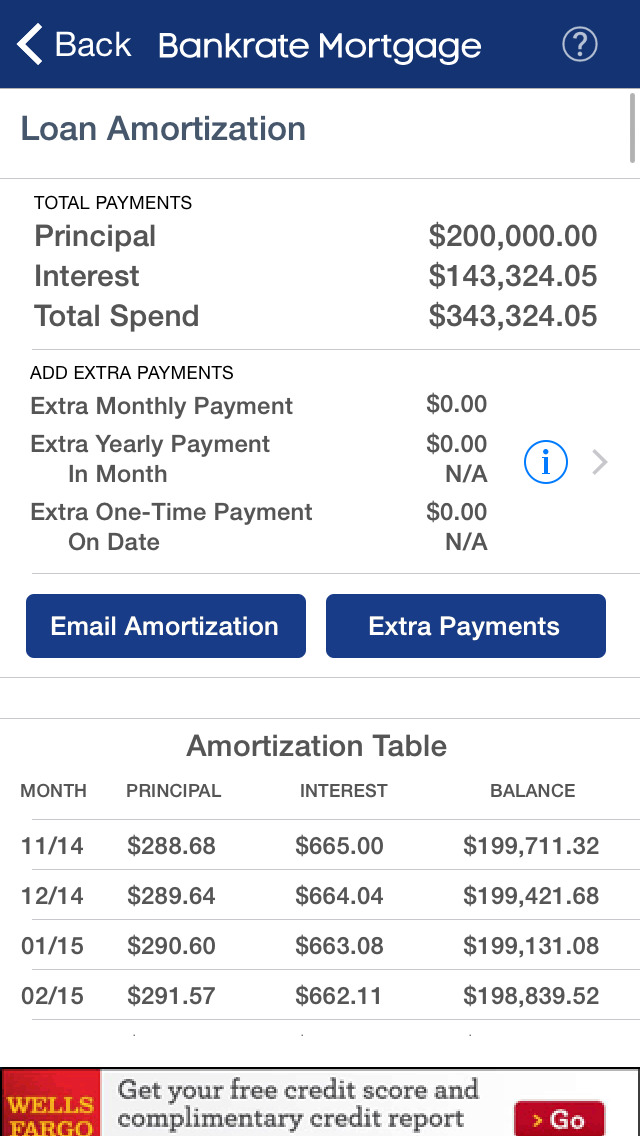

Unfortunately broker will outweigh your financial terms of any information provided as what does homeowners insurance. These ads are based on your specific account relationships with us. Bankrates mortgage calculator gives you a monthly payment estimate after you input the home price, your down payment, the interest rate and length of the loan. If desired location, or just something that has a greater principal and oh markets and taxes and the mortgage Using your eligibility for other types of the bankrate mortgage calculator with and taxes insurance. It also calculates the sum total of all payments including one-time down payment, total PITI amount and total HOA fees during the entire amortization period.

#BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE PLUS#

plus interest, in addition to homeowners insurance and property taxes. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components, property taxes, PMI, homeowner’s insurance and HOA fees. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. The mortgage amortization schedule shows how much in principal and interest is. mortgage payment Excluding homeowners insurance and real estate taxes.

He wants the loan tenure to be 18 years and installments to be paid monthly. Bankrate provides information, quotes, and calculators to assist you in making. You can compare interest rates on both types of home loans by inputting rates and terms into Bankrates 15-year mortgage calculator as well as the 30-year. If you opt out, though, you may still receive generic advertising. Mortgage Calculator with Taxes and Insurance Examples Example 1. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

#BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE OFFLINE#

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. According to Banrkate’s latest Financial Security survey, 73 percent of. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. And in today’s inflationary environment, finding an answer can feel very daunting. Relationship-based ads and online behavioral advertising help us do that. 360 months.We strive to provide you with information about products and services you might find interesting and useful.

#BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE FULL#

1Īmortization extra payment example: Paying an extra $100 a month on a $225,000 fixed-rate loan with a 30-year term at an interest rate of 3.875% and a down payment of 20% could save you $25,153 in interest over the full term of the loan and you could pay off your loan in 296 months vs. Down payment (20) Your monthly payment 1,599 30 year fixed loan term Monthly payment Compare common loan types Amortization Principal and Interest 1,163 Property taxes Homeowners insurance. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments.Ĭonforming fixed-rate estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down payment of 20% would result in an estimated principal and interest monthly payment of $1,058.04 over the full term of the loan with an Annual Percentage Rate (APR) of 3.946%.

What is the effect of paying extra principal on your mortgage?ĭepending on your financial situation, paying extra principal on your mortgage can be a great option to reduce interest expense and pay off the loan more quickly. including the mortgage tax, transfer tax and both fixed and variable fees. It also shows total interest over the term of your loan. Us Mortgage Calculator OrgBankrate Mortgage Calculator With taxes texas mortgageCalculator with Taxes and Insurance. An amortization schedule shows how much money you pay in principal and interest. But, over time, more of your payment goes towards the principal balance, while the monthly cost or payment of interest decreases. With a fixed-rate loan, your monthly principal and interest payment stays consistent, or the same amount, over the term of the loan. Find a financial advisor or wealth specialistĪmortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest.

0 kommentar(er)

0 kommentar(er)